The economic crisis, the difficulty in finding work, and the lack of prospects push many people to seek solutions through "gambling," taking on increasingly bigger risks in search of an escape. In this context, money shifts between various financial assets, creating a speculative environment that can negatively affect the economy in the long term.

Government bonds, stocks, and other financial instruments can experience fluctuations in their value due to various factors, leading to a betting dynamic where some benefit while others are harmed. Often, these practices focus on individual gains that exclude the majority of the population.

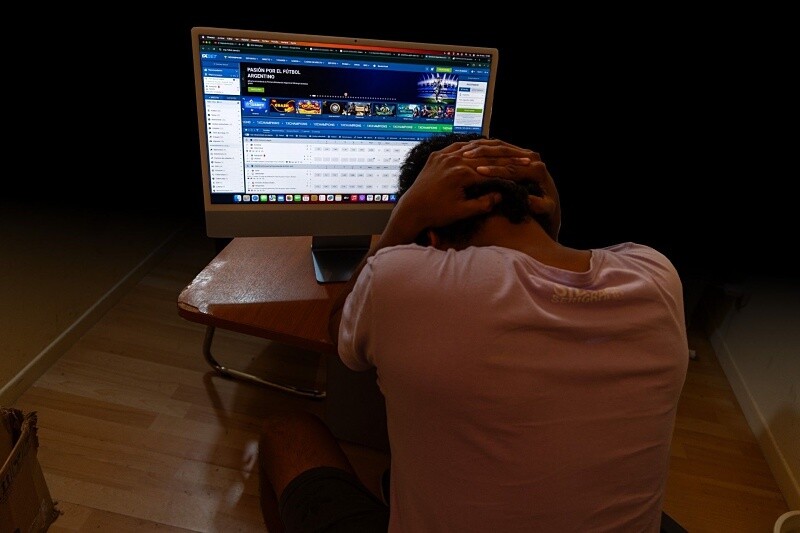

The advertising and promotion of quick and high-yield financial schemes fuel the idea of "easy money," diverting attention from the reality of work as the main generator of wealth in society. Gambling and other forms of betting become attractive in a context of economic uncertainty, where the population seeks immediate solutions to structural problems.

The need for economic policies that promote the diversification of activities, strengthen the internal market, and create jobs becomes urgent to counteract the negative effects of speculative financial practices. Citizen participation and solidarity emerge as fundamental tools to change these conditions and build a fairer and more equitable future for all.

In summary, the pursuit of easy money through risky investments and deceptive financial schemes can have negative consequences both at the individual level and on the economy as a whole. It is necessary to promote a culture of responsible finance and work on policies that drive sustainable and equitable economic development to achieve true long-term progress.